PNN® AI Investment Innovations

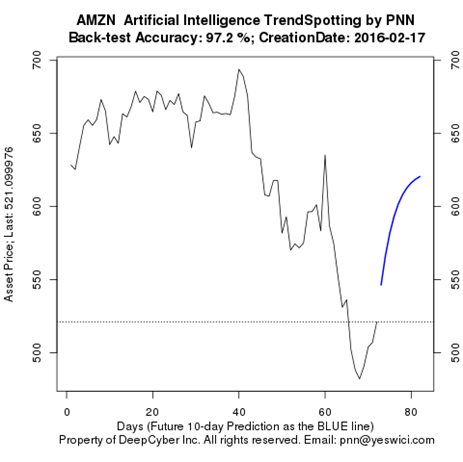

We use the first Trendspotting AI® machine to lift mission-critical alpha for PNN AI funds with respectable model accuracies.

PNN AI Technologies extend & automate the trendspot framework by Shiller-Fama (Nobel 2013) showing asset trends are predictable.