Yeswici (YesWeSee) is a quantitative modeling and computing platform for innovative investment research. The platform transfers investment research into Internet/mobile apps and services. The audience of the platform includes (1) portfolio managers, traders, financial advisors and investment analysts with quant background; (2) corporations and institutions that care about their ticker performance and market volatility; (3) high-net-worth investors who appreciate real-time stock recommendations, financial news and stock insights from the crowd.

Comparing to MorningStar's charting with historical data, the premium app of the platform, SentimentAssetPricingEngine (SAPE), visualizes real-time future asset prices. The engine aggregates a large amount of traders' real-time sentiments on the future prices of stocks or ETF funds. The financial value of the SAPE may be assessed by the stock picking (advisory) fees of mutual funds. For example, Fidelity Magellan (FMAGX) took in $3.7 billion fees during the 1999-2008 period.

SAPE entails a unique set of computer algos that aggregate traders’ real-time sentiment to estimate an individual asset’s future prices. It fills the gap of the Black-Scholes model and other Nobel models that did not consider behavioral factors in asset pricing. Comparing to the Nobel models that provide theories and formulas, SAPE provides an end-to-end solution to portfolio management, including a new theory on behavioral investing, a new formula on estimating future prices of individual assets, and a new computer system for real-time future asset pricing, asset allocation, and market timing.

Desktop: visualFunds download

More on SAPE algos appear in Dr. Gewei Ye’s new book: "High-Frequency Trading Models," released in January 2011 by John Wiley & Sons, Hoboken. The book, at Wiley, includes teaching notes for training Hopkins graduate students to be top portfolio managers and investment experts with humanity in mind. See a sample chapter entitled "Loss Aversion in Option Pricing: Integrating Two Nobel Models."

(This site is for academic use; SAPE funds are effective with sophisticated arbitrage and hedging strategies; consult an investment expert or contact info@yeswici.com before exercising on SAPE charts)

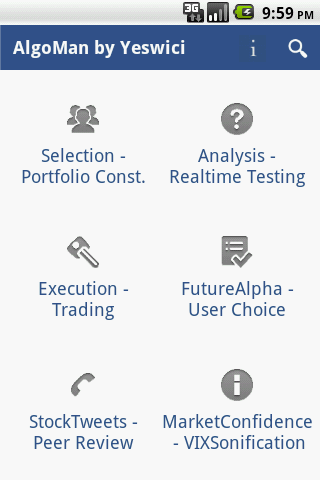

AlgoManager: Automate Construction, Strategy Testing & Execution